Dubai Real Estate News 2026: Outlook & Key Trends

Dubai Real Estate News 2026. Prices, rents, supply, off-plan launches, financing, and policy updates buyers and investors should know

The story behind Dubai Real Estate News 2026 is not a simple boom narrative.

After record transactions and steep appreciation in 2024–2025, the market heads into 2026 with three forces in play: still-strong demand, a large pipeline of new supply, and a friendlier mortgage backdrop as global rates ease.

Prime and family villa communities remain resilient. Mid-market apartments in supply-heavy corridors may stabilize or soften as handovers peak.

Meanwhile, off-plan remains a dominant sales channel and policy levers like the Golden Visa continue to pull global capital.

Key consultancies confirm prices are above prior peaks and that off-plan sales led 2025 activity, while authorities reported H1 2025 as a record half for transactions.

In this article, we will discuss what you can expect in the year ahead.

Market Backdrop: Record 2025 Sets the Stage for 2026

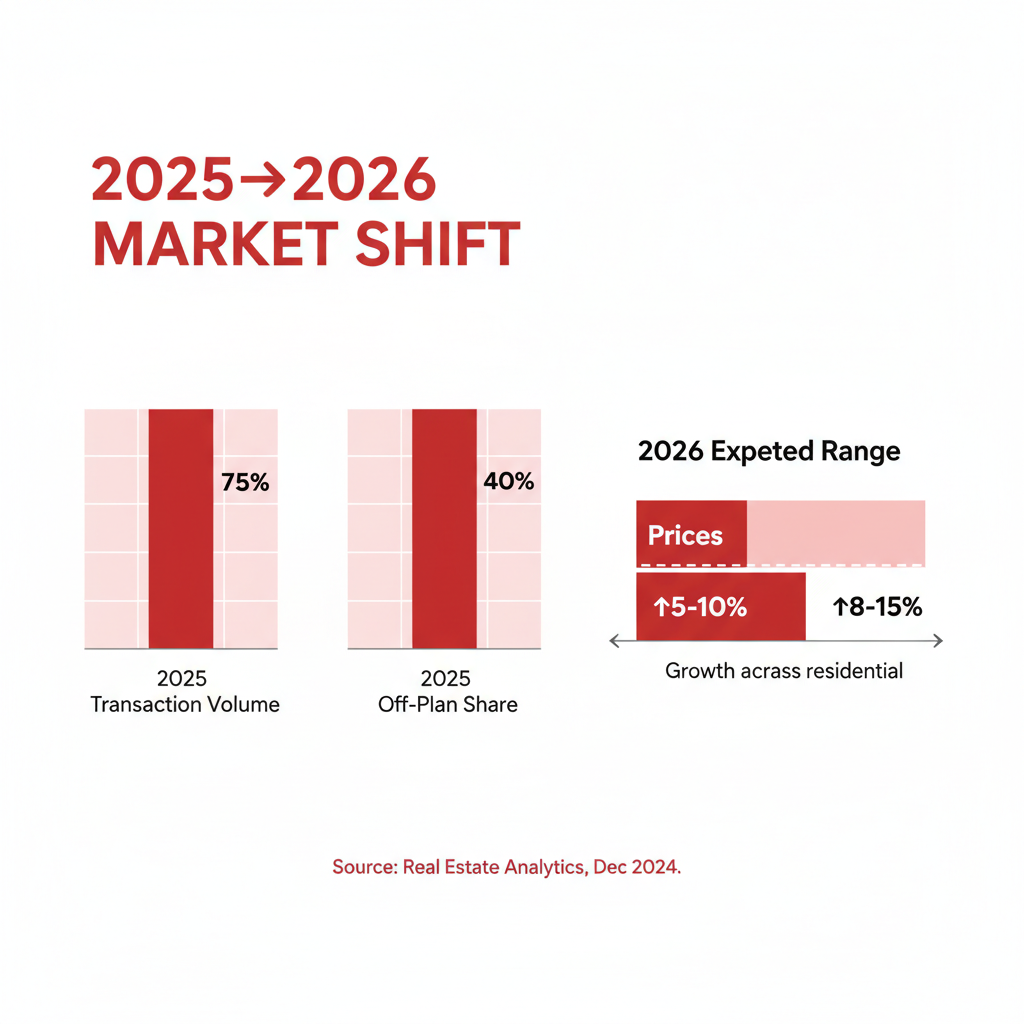

By Q1–Q2 2025, Dubai’s residential prices were above the 2014 peak, with villas leading gains and off-plan accounting for the bulk of transactions.

The Dubai Land Department reported 125,538 real estate transactions in H1 2025, up 26 percent year-over-year, underscoring the depth of demand entering 2026.

Consultancy data show citywide prices near AED 1,749 per sq ft in Q1 2025, with 69 percent of sales off-plan that quarter.

Independent outlooks highlight both confidence and caution. CBRE’s UAE Market Review captured strong 2025 momentum and an active pipeline.Others flag that as a large wave of deliveries arrives in late 2025–2026, certain segments may cool from rapid growth to a more sustainable pace.

What’s Likely in 2026: Five Big Themes

1) A Gradual Shift from Surge to Balance

Prices:

Prime and family-oriented villa districts should remain firm due to constrained quality stock. Citywide, the rate of increase likely slows versus 2024–2025 highs as completions rise. Knight Frank’s 2025 data confirm values above prior peaks, led by villas.

Transactions:

Sales volumes stay healthy, supported by off-plan launches and end-user conversion from renting as financing costs ease. Authorities documented a record H1 2025 base.

Risk pockets:

Mid-market apartment clusters with heavy handovers may face stiffer competition and flatter pricing.

2) Off-Plan Still in the Driver’s Seat

Off-plan dominated 2025 activity and continues into 2026 as developers stage launches with flexible payment plans. In Q1 2025, off-plan represented 69 percent of sales. Expect continued depth of product from branded residences to mid-market communities.

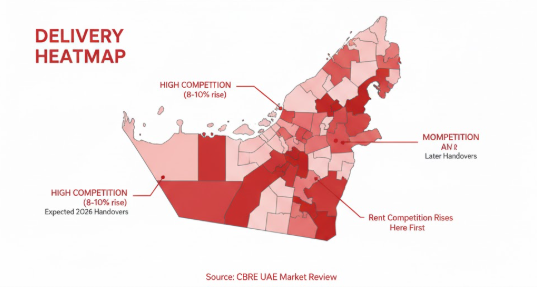

3) Rentals Ease from Peak Heat

Rents surged in 2022–2024. As handovers increase in 2026, pressure should ease in supply-heavy districts while prime areas remain tight. CBRE’s 2025 UAE review flagged robust delivery expectations supporting a gradual re-balancing.

4) Policy Tailwinds Stay Supportive

Golden Visa pathways linked to property ownership, transparent transaction frameworks, and economic initiatives keep Dubai favorable for cross-border capital. DLD’s open data and frequent reporting reinforce market transparency.

5) Financing Becomes Friendlier

With the first policy rate cut in late 2025 and expectations of further easing into 2026, mortgage affordability improves, nudging some renters to become first-time buyers and aiding overall liquidity.

Segment-by-Segment Outlook for 2026

Prime & Family Villas

Drivers:

Lifestyle demand, school and amenity proximity, limited ready stock.

Outlook:

Price growth moderates but remains positive in top communities due to scarcity and international wealth inflows. Knight Frank’s 2025 review shows villas as standout performers.

Where to watch:

Palm Jumeirah, Dubai Hills Estate, Arabian Ranches, Emirates Living.

Mid-Market Apartments

Drivers:

Value-seeking end-users and yield-minded investors.

Outlook:

Stabilization in clusters with significant 2025–2026 handovers. CBRE highlights a busy delivery pipeline into year-end, which supports a healthier tenant-landlord balance.

Where to watch:

Business Bay, Jumeirah Village Circle, Dubai South corridors linked to Expo City.

Off-Plan Launches

Drivers:

Flexible payment plans and capital appreciation potential.

Outlook:

Still strong in 2026, diversified by price points and brands. Due diligence on developer track record and completion timelines is essential.

Rentals

Drivers:

Population growth and relocations vs. new supply.

Outlook: Softer pace of rent growth in supply-heavy areas; resilience in blue-chip beachfront and urban-core apartments.

2026 Cheat Sheet

| Segment | 2025 Signal | 2026 Expectation | What It Means For You |

| Prime villas | Values outperformed citywide; limited stock | Moderate growth, low vacancy | Family buyers and UHNW investors stay active; pricing power persists |

| Mid-market apartments | Strong off-plan sales; high pipeline | Stabilization in supply-heavy nodes | Buyers gain options and bargaining power; focus on quality and service charges |

| Off-plan | 69% of sales in Q1 2025 | Still dominant in 2026 | Favor reputable developers; check escrow and milestone schedules |

| Rentals | Record-high rents through 2024 | Gradual easing in oversupplied areas | Tenants get leverage; landlords sharpen pricing and incentives |

| Financing | First rate cut late 2025 | Incremental easing in 2026 | Better affordability; more renters convert to owners |

Policy & Regulation Notes Buyers Should Track

Residency via Property:

Long-term visas tied to real estate remain a magnet for global investors and relocating professionals. Consult official DLD resources and immigration guidelines during purchase planning.

Transparency & Digitization:

Oqood registrations, REST app services, and frequent data releases improve confidence and speed. Keep documents ready for faster approvals.

Cost of Purchase:

Budget for DLD fees and agency commissions in cash on top of down payments. Banks tend to exclude these costs from financing. CBRE’s market reviews can help track fee norms and bank policy shifts.

How 2026 Could Change the Math

The best part of Dubai Real Estate News 2026 for end-users may be financing.

As benchmark rates edge down from 2025 highs, affordability improves at the margin. The effect is twofold. First, monthly installments decrease for a given loan size.

Second, more buyers qualify for higher loan amounts, nudging some renters to purchase in 2026. For investors using leverage, cheaper debt widens the spread between gross yields and borrowing costs, improving cash-on-cash returns. CBRE’s Q2 2025 review notes robust conditions and a steady pipeline that should keep liquidity active as rates ease.

Neighborhood & Asset Strategy for 2026

1) If you want resilience:

Favor family villas or townhouses in mature, amenity-rich districts with limited new land. These areas retained pricing power through cycles. Use our on-the-ground insights to shortlist options in Dubai Hills Estate, Arabian Ranches, and Palm Jumeirah.

See available For Sale listings and request a curated tour.

2) If you want value and upside:

Target high-quality mid-market apartments in zones gaining infrastructure and schools and where service charges make sense against achievable rents. Monitor Business Bay and JVC handover calendars to time entries. For rental seekers, browse Apartments for Rent in Dubai for current availability and price points.

3) If you prefer off-plan:

Prioritize developers with clean delivery records and escrow discipline. Compare payment schedules on like-for-like projects and analyze rent comps on handover. Our team can map launch calendars and match you to communities suited to your budget and goals.

Start with our investor primers like Top 5 Tips for First-Time Property Investors in Dubai. 4) If you are sustainability-minded:

Shortlist projects and communities with energy-efficient design, water stewardship, and transit accessibility. Our guide to Eco-Friendly Developments in Dubai can help you evaluate green value.

Quick Stats to Watch in 2026

Citywide price trend vs. 2025 peak readings. Knight Frank’s Q1 2025 baseline: ~AED 1,749 per sq ft.

Quarterly deliveries across apartment clusters and villa districts. CBRE’s UAE reviews frequently cite expected handovers.

Off-plan share of sales and launch absorption rates. Knight Frank flagged 69 percent off-plan in Q1 2025.

H1/H2 transaction volumes from DLD and Media Office updates.

How Keller Williams Helps You Act On This

Local pricing intel:

We overlay consultancy and DLD data with neighborhood-level comps to identify micro-opportunities others miss.

Launch and handover calendars:

We help time entries around supply bulges or limited-inventory drops.

Full-cycle support:

From property selection to negotiation, due diligence, mortgage introductions, and post-handover leasing or resale strategies.

Frequently Asked Questions

Q1) Is 2026 a good year to buy property in Dubai?

If you seek end-user stability or long-term investment, 2026 offers better selection and potentially more negotiable pricing in certain apartment clusters, with villas holding firm in top areas. Easing mortgage rates add affordability. Always compare service charges, expected rents, and developer history. For curated options, start here: https://kellerwilliamsdubai.ae/for-sale/.

Q2) Will rents fall in 2026?

Expect moderation rather than a broad decline. Supply-heavy corridors may see softer asking rents and incentives, while blue-chip urban cores and beachfront remain tight. Check quarterly delivery reports to time lease renewals.

Q3) What about off-plan risk?

Use escrow-protected projects, examine milestone schedules, and favor experienced developers. Track off-plan’s share of sales and launch absorption. Knight Frank’s Q1 2025 reading offers a useful benchmark entering 2026.

Conclusion

If you have been following Dubai Real Estate News 2026, the message is clear. After a record 2025, the market is set to evolve rather than reverse. Prime and family-centric villas should stay resilient. Apartment clusters with heavy 2026 handovers may stabilize as tenant choice expands. Off-plan will continue to set the pace, and a friendlier mortgage environment can lift end-user demand. Policy support and transparency remain pillars for global investors.

For personalized guidance on where these trends meet your goals, explore For Sale and For Rent or speak to our advisors for a data-driven plan tailored to your budget and timeline. And keep this page bookmarked. We will continue to update Dubai Real Estate News 2026 with fresh reads as new quarterly numbers land.